Closing Down Contour Keks $1 deposit Spend: Earn $one hundred Having A primary Put

Blogs

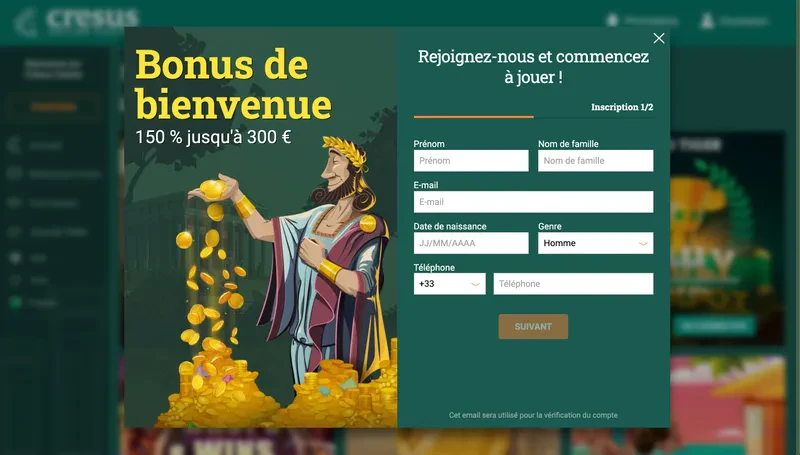

Consequently, the amount of money you really need to have before you are required so you can document a U.S. income tax get back is lower compared to relevant number inside Desk 1-step 1 or Desk 1-2. Want to gamble preferred harbors and online casino games with reduced risk? Really step 1$ put gambling enterprises allow you to begin with tons of totally free revolves to the Canada’s most popular harbors. Whether or not wagering standards step one-money deposit incentives might be higher, it is typical because helps in avoiding extra discipline if you are guaranteeing the fresh professionals as you to test other video game and perhaps come across a the new favourite position. For example refunds as a result of taxes that were overwithheld, applied away from a past-seasons come back, perhaps not decided truthfully, or decided once again due to a revised come back.

Keks $1 deposit | 2: Write in the fresh Payee’s Identity

You always can be’t subtract the costs should your reserve meeting are stored to the a day on what you don’t focus on their typical employment. In this Keks $1 deposit case, the transportation may be an excellent nondeductible driving expenses. Although not, you might subtract the transportation expenses if the precise location of the fulfilling is short-term along with one or more typical towns away from functions. Transport expenses you’ve got in going anywhere between household and a part-go out work to your 24 hours faraway from your primary work is actually driving expenses. You could potentially’t subtract every day transportation costs between the household and you may temporary work internet sites within your urban urban area. Should your temporary functions venue may be out of all round area of the normal work environment and you also sit immediately, you are travelling away from home.

To your definition of “car” to have depreciation motives, discover Vehicle discussed below Real Car Costs, after. You can subtract the price of bullet-excursion transportation involving the being qualified home office plus buyer’s or buyers’s bar or nightclub. Dragging products otherwise tools in your vehicle when you’re travelling to and you can out of works doesn’t create your vehicle expenditures deductible. Although not, you might subtract any extra will set you back you have got to have hauling products or tool (including to possess renting a trailer your pull together with your auto).

- There are plenty of banks providing incentives to open the brand new membership.

- Any website that really needs visitors to purchase their funds must interest on the bringing strong customer service.

- You don’t have to generate projected tax money if you do not has money about what you’ll are obligated to pay tax.

- Where you can find a strong set of game and you can a leading-ranked VIP bar, Gambling establishment High also offers per week reload incentives, individuals acceptance also provides, and you can totally free potato chips galore.

- And straight when you generated the third deposit you get the new added bonus money into your account.

In most claims, you could document an electronic condition return as well with your government come back. To find out more, speak to your local Internal revenue service office, state taxation service, taxation elite, or perhaps the Internal revenue service site from the Irs.gov/efile. If the return are recorded that have Irs e-document, you are going to found an acknowledgment that your particular return try obtained and you can acknowledged. For those who are obligated to pay taxation, you can elizabeth-document and you may pay electronically. The new Internal revenue service provides processed multiple billion e-filed output safely and you can safely.

Finishing Setting W-4 and Worksheets

Listed here are very important reminders or other products which could help you document your own 2024 tax get back. All of these products are explained in more detail after within the that it guide. The application form making it possible for their refund getting transferred in the TreasuryDirect® account to buy discounts bonds, plus the power to purchase papers ties along with your refund, might have been discontinued. Form 8888 is becoming just always broke up your head put reimburse between several profile or perhaps to split their refund anywhere between a direct deposit and you may a paper consider. To find out more, go to TreasuryDirect.gov/Research-Center/Faq-IRS-Tax-Feature. For those who gotten electronic assets since the typical earnings, and therefore income is not stated somewhere else on the return, you are going to get into those individuals amounts to the Plan step one (Mode 1040), range 8v.

Activity costs is various itemized write-offs and certainly will no more become subtracted. Assessment charges you pay to find a casualty loss or the reasonable market value of contributed possessions is actually miscellaneous itemized deductions and you can cannot become subtracted. You can not any longer claim people miscellaneous itemized deductions.

To the October 15, 2024, your recorded an amended get back and said a reimbursement of $700. Other than being best for bettors with limited funds, 1 money put gambling enterprises allow it to be first-date professionals discover an end up being for an internet site as opposed to digging too deep in their purses. If that wasn’t sufficient, you may also allege nice 100 percent free revolves incentives and much more with simply $step one, and gamble gambling games one undertake lowest minimal bets. Put simply, all you need is $1 first off having a great time from the Canada’s best-ranked online casinos. You ought to claim a no-deposit bonus because it offers the opportunity to winnings real cash with no risk to your individual money.

All of our Props.com people has elected an educated on the internet sportsbook incentives, in addition to extra bets, deposit incentives, and you can choice credits. All these incentives excel as they possibly can spend lots of cash and they are obvious. Nonetheless they act as worthwhile welcome bonuses in some cases. As we know, a welcome incentive is only open to first-date depositors. To play at the web based casinos that provide several safe commission method makes to have an even more fun gambling experience, because you don’t have to hold out to own fund going to your account or for days to really get your earnings. Brush through to an enthusiastic operator’s readily available put and you can withdrawal alternatives, restrictions, and you may payout speed just before performing a merchant account.

What’s more, it boasts reimbursements or other costs allowances paid back below a good nonaccountable bundle. See Extra Earnings, later, to find out more on the reimbursements and you can allowances paid less than a great nonaccountable plan. Once you profile exactly how much taxation you need withheld out of your earnings and when you shape their projected income tax, imagine income tax legislation changes good at 2025. To find if you considering more than half from somebody’s support, you need to basic determine the total support provided for that person. Complete service boasts number invested to provide eating, lodging, dresses, training, medical and you will dental care, athletics, transportation, and you will comparable fundamentals. In the event the children obtains social protection professionals and spends her or him to your their support, the huge benefits are considered while the provided by the kid.

Worksheet 9-2. Altered AGI to own Roth IRA Motives

You must offer your employer an identical kind of info and you can supporting guidance that you’d have to give you to the Irs should your Irs questioned a deduction on your own get back. You should pay the amount of any reimbursement and other costs allowance the place you don’t adequately membership or that is more than the quantity to have which you accounted. Inside the April 2018, you bought and you can placed in solution a car you made use of solely on your business. Your didn’t allege a part 179 deduction or the special depreciation allocation for the car. Your continued to make use of the vehicle 100% on your company in the recovery several months (2018 thanks to 2023). Your own decline write-offs had been subject to the newest decline limitations, you will get unrecovered basis at the conclusion of the newest healing period since the revealed regarding the pursuing the dining table.